U.S. GRAIN IN ALL FORMS EXPORTS UP 25.2 PERCENT

Lindsay Mitchell

This article originally posted here.

Shifting dynamics in world markets and continuous market development efforts resulted in growing demand for U.S. feed grains and ethanol in the first four months of the 2018/2019 marketing year, according to data from the U.S. Department of Agriculture (USDA) and analysis by the U.S. Grains Council (USGC).

Overall exports of feed grains in all forms were up 25 percent year-over-year at 38.9 million metric tons (equivalent to 1.53 billion bushels) during September 2018-December 2018, compared to the same time period the prior year. By commodity, U.S. exports of corn, dried distillers grains with solubles (DDGS) and ethanol continue to realize substantial growth in both established and developing markets.

World Buyers Upping U.S. Corn Purchases

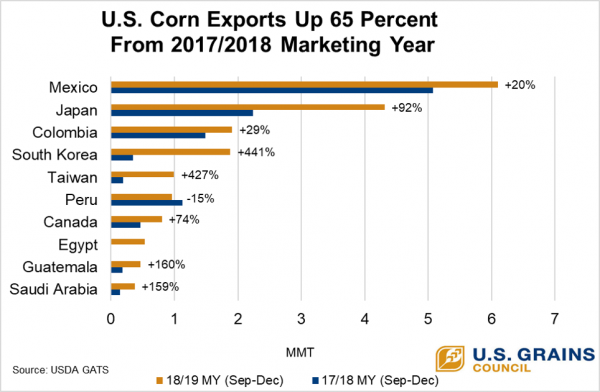

Nine of the top 10 U.S. corn buyers upped purchases year-over-year, resulting in an overall increase of 64.6 percent at nearly 20.4 million tons (803 million bushels). Mexico continues to represent the largest buyer of U.S. corn at 6.09 million tons (240 million bushels) with a 20 percent increase in imports thus far in the marketing year. Japan – the second largest buyer last marketing year – nearly doubled U.S. corn purchases to 4.31 million tons (170 million bushels).

Colombia, rounding out the top three buyers, increased U.S. corn imports 28.7 percent year-over-year to 1.91 million tons (75.2 million bushels). USGC members recently toured end-users in Colombia, following the Council’s meeting in Cartagena, to see firsthand how U.S. corn is used in feed plants, food processing, manure processing and liquid egg production.

South Korea, Taiwan, Canada, Guatemala and Saudi Arabia have also increased imports of U.S. corn thus far in the marketing year.

Notably, Egyptian purchases of U.S. corn jumped to 530,000 tons (20.9 million bushels) thus far in the marketing year, breaking into the top 10 buyers and already exceeding total purchases in 2016/2017. The Council continues to provide information to buyers in that market, including putting U.S. farmers front and center during events like this year’s corn quality report rollout.

Eight of the top 10 U.S. DDGS buyers also increased purchasing, driving a slight 5.3 increase overall to 3.95 million tons. While Mexican imports are currently down year-over-year, the country still represents the largest U.S. DDGS buyer at 616,000 tons.

Vietnamese DDGS imports continue to rebound with purchases jumping 67 percent to 504,000 tons thus far in the marketing year. USGC staff recently traveled to witness the discharge of the first bulk vessel of U.S. DDGS sold under new fumigation protocols established in 2017, following successful container shipments.

Southeast Asian buyers, including Indonesia and Thailand, continue to increase imports of U.S. DDGS – up 11 percent and 36 percent, respectively. Purchasing by the European Union, Canada and Japan are also up year-over-year.

U.S. Ethanol Exports Continue Rapid Growth

Ethanol exports continue rapid growth with nine of the top 10 buyers expanding purchases year-over-year, resulting in an overall increase of 18.2 percent to nearly 553 million gallons.

Ethanol exports to the top two U.S. markets – Canada and Brazil – are both up significantly from the prior year. Brazil, now in between sugarcane harvests, is supplementing domestic ethanol production with U.S. ethanol to satisfy domestic demand. As a result, U.S. exports to Brazil – the largest purchaser of U.S. ethanol – increased 48 percent year-over-year to 148 million gallons.

Regional increases in demand resulted in an 11 percent increase of exports to Canada at 122 million gallons as individual provinces work to boost blend rates beyond the mandated E5 national level.

As both countries seek to implement new biofuels policies, market potential for U.S. ethanol continues to look promising. The Council and its partners in ethanol export market development – including Growth Energy and the Renewable Fuels Association – are supporting positive policy developments in both of these markets by offering recommendations on how ethanol can help promote economic growth and help achieve climate goals.

Exports to the European Union, the Philippines, Colombia and Peru are also up compared to the previous marketing year. Notably, U.S. ethanol exports to South Korea have more than doubled year-over-year to nearly 34.5 million gallons.

The Council will continue to help U.S. farmers and agribusinesses seize short-term market opportunities and develop long-term customers for U.S. feed grains and ethanol.