Budget Reconciliation Bill Passes Congress

Supporting Progress, Calling for Fixes: IL Corn Responds to the passed Budget Reconciliation Bill

Illinois corn farmers will be impacted by many provisions in the Budget Reconciliation Bill that passed in both chambers this week. Some provisions are good, some are less positive; IL Corn’s biggest concerns are around base acre updates, crop insurance changes, and viability of future Farm Bills.

Budget Reconciliation Breakdown

- Tax components of the bill are largely very positive for farmers, including:

- Estate Tax Relief will help farm families to pass their farm to the next generation

- Ensuring Permanency for 199A Qualified Business Income Deduction helps agricultural producers and farmers compete with larger corporations by allowing them to keep a portion of their income

- Making the Lower Individual Tax Rates and Expanded Tax Brackets Permanent in the Tax Cuts and Jobs Act are essential—allows farmers to reinvest and manage increased production costs

- Increasing Section 179 Expensing from $1 million to $2.5 million—important for substantial investments in equipment and technology: encouraging investment, productivity, and innovation

- Restoring 100% Bonus Depreciation enables essential investments in equipment and infrastructure without delayed tax benefits for the latest technologies and practices to enhance efficiency

- Securing a longer runway for 45Z incentives helps sustainable aviation fuels (SAF)—creating future markets for ethanol, but the reduced value of the credit may delay development

- Farm Bill components are more mixed and IL Corn is:

- Very appreciative of the doubling of Market Access Program and Foreign Market Development (MAP and FMD) funds which help to increase exports pf corn and corn products like ethanol and meats

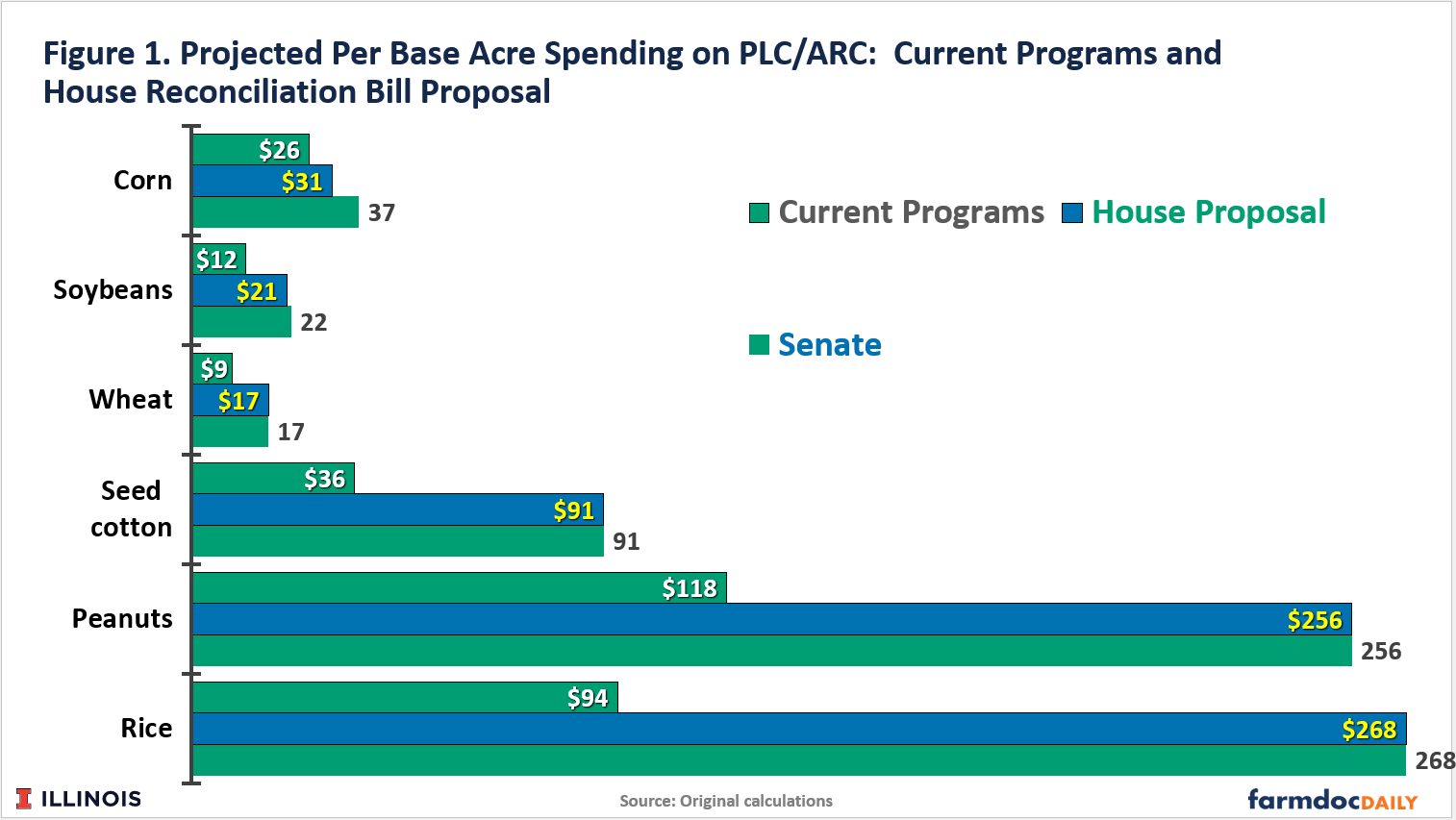

- Pleased with the charges to the Agricultural Risk Coverage (ARC) program that better align corn payment rates. Review the proposed payment rates for program commodities in the chart below.

- Disappointed that a “mandatory base acre update” was not included, as this provision would have saved money by aligning farm program payments on recent planting history rather than a planted history going back to 1980

- Concerned with changes to crop insurance that may reduce the performance of the crop insurance program for Midwest farmers

- Disappointed in the level of cuts to the SNAP program, which may inhibit future Farm Bills

“While we are thankful for some positive language for corn farmers in the Budget Reconciliation Bill, but there are still some concerns that will affect Illinois farmer’s bottom line. Our members expect us to advocate for them in conversations just like these,” said Garrett Hawkins, Illinois farmer and IL Corn Growers Association President. “We are thankful for so many positive changes, but will be paying close attention to our concerns and will work to get them addressed for Illinois farmers.”

IL Corn will continue to advocate for policies that benefit Illinois corn farmers. We appreciate the support for agriculture but urge lawmakers to continue making changes that improve the lives of farm families.