Internal Combustion Engine Ban Could Devastate Agriculture

A new study released by the Agricultural Retailers Association (ARA) finds that U.S. light-duty and freight vehicle consumption of ethanol and biodiesel could decline up to 90 percent to 1.1 billion gallons and up to 61 percent to 0.8 billion gallons, respectively if a discussed ban on internal combustion engines becomes a reality.

Corn and soybean consumption could decrease by up to 2.0 billion bushels and up to 470 million bushels, respectively if a ban is put into place. Additionally, corn prices are projected to fall up to 50 percent to $1.74 per bushel, while soybean prices fall up to 44 percent to $4.92 per bushel in response to a ban.

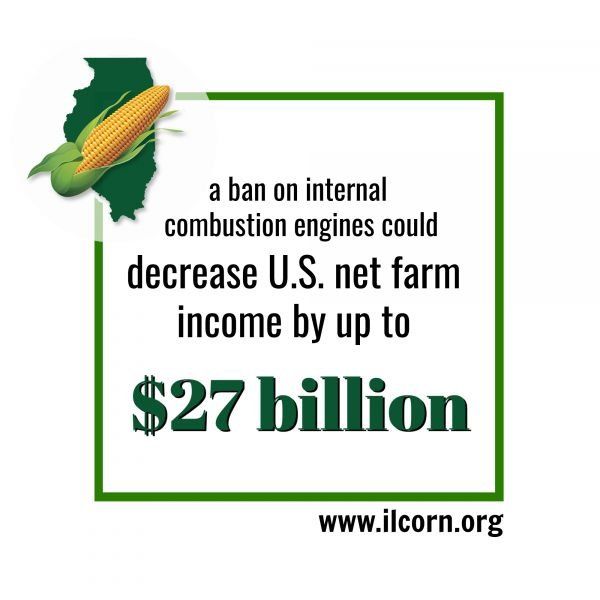

In this scenario, U.S. net farm income would decrease by up to $27 billion.

The study uses proposals to ban internal combustion engine vehicles by 2035 and 2050 to serve as the economic models for the study, along with a base case provided by the U.S. Energy Information Administration’s Annual Energy Outlook.

The study makes clear that an internal combustion engine vehicle ban could devastate the agriculture community.

Proposals that seek to rush this ban to 2035 have the most severe impacts, but any ban results in dramatic decreases in ethanol, biodiesel, corn and soybean prices, and demand for fertilizer and other agricultural products. These are burdens carried disproportionately by the agriculture community.

Using the study’s estimated acreage reduction of 5 to 7 million acres of corn as an example, the impact on fertilizer alone is significant. In that scenario, nitrogen demand impact is approximately 800,000 to 1 million tons of urea and UAN each, assuming that direct application of ammonia volume remains constant. This represents about 15 percent of the urea market and 7% of the UAN market in the U.S., which will have a significant impact on fertilizer prices.

Further, the study shows that the economic losses throughout the biofuels value chain range from $105 billion to $185 billion, and cumulative federal, state, and local tax revenues losses range from $39 billion to $69 billion through 2050.

This study used POLYSYS and IMPLAN to derive the agricultural and economic impacts of this study.