On April 2nd, President Trump announced a new Executive Order that will apply reciprocal tariffs (import taxes) on goods from around the world to, “rectify trade practices that contribute to large and persistent annual United States goods trade deficits.”

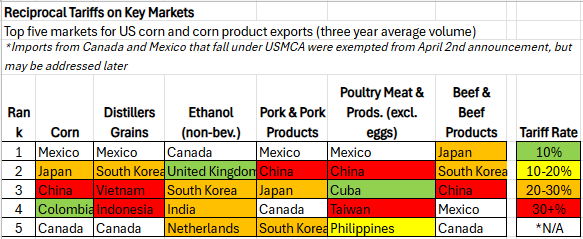

The new tariff schedule will hit some of the top markets for US corn and corn products, including DDGS, ethanol, red meats and poultry with taxes ranging from 10% (the new minimum rate) in Colombia, to 46% in Vietnam.

Imports from Canada and Mexico are exempt from these tariffs if the product meets United States-Mexico-Canada Agreement (USMCA) rules of origin. Canadian energy and potash imports are excluded from the new tariffs. However, Canada and Mexico were previously targeted under the immigration and drug trafficking emergency declaration, and those tariff threats remain on the table.

Certain critical imported goods—like some building materials, metals and minerals, pharmaceuticals, and drug precursors—are also exempt from these import duties.

The Executive Order allows for modification of tariff rates. Any retaliation in response to the Order is grounds for the US to increase or expand tariffs, while any movement to reduce barriers to trade for US goods may be grounds for the Administration to reduce or limit tariffs.

The new Executive Order has provided a lot more clarity to the situation, but there are still uncertainties. The biggest unknown now is how countries will retaliate against the US. IL Corn will continue to follow these tariffs and will provide more information when it becomes available.