From Corn fields to Capitol: Building Markets, Securing Futures

From Illinois Fields to Foreign Markets, Trade Drives Farmer Opportunity

For generations, America’s farmers have built strong trading relationships to help maintain a competitive landscape in the global economy. Trade deals and agreements with other countries opened the doors for corn, ethanol, and feed grain sales. Trade has grown increasingly vital for farmers as production of our commodities continues to increase.

Policies like the United States-Mexico-Canada Agreement (USMCA) made the U.S. a trusted supplier, creating steady demand for grain. This demand becomes uncertain when trade disputes disrupt the markets, leading to lower prices and limited export opportunities.

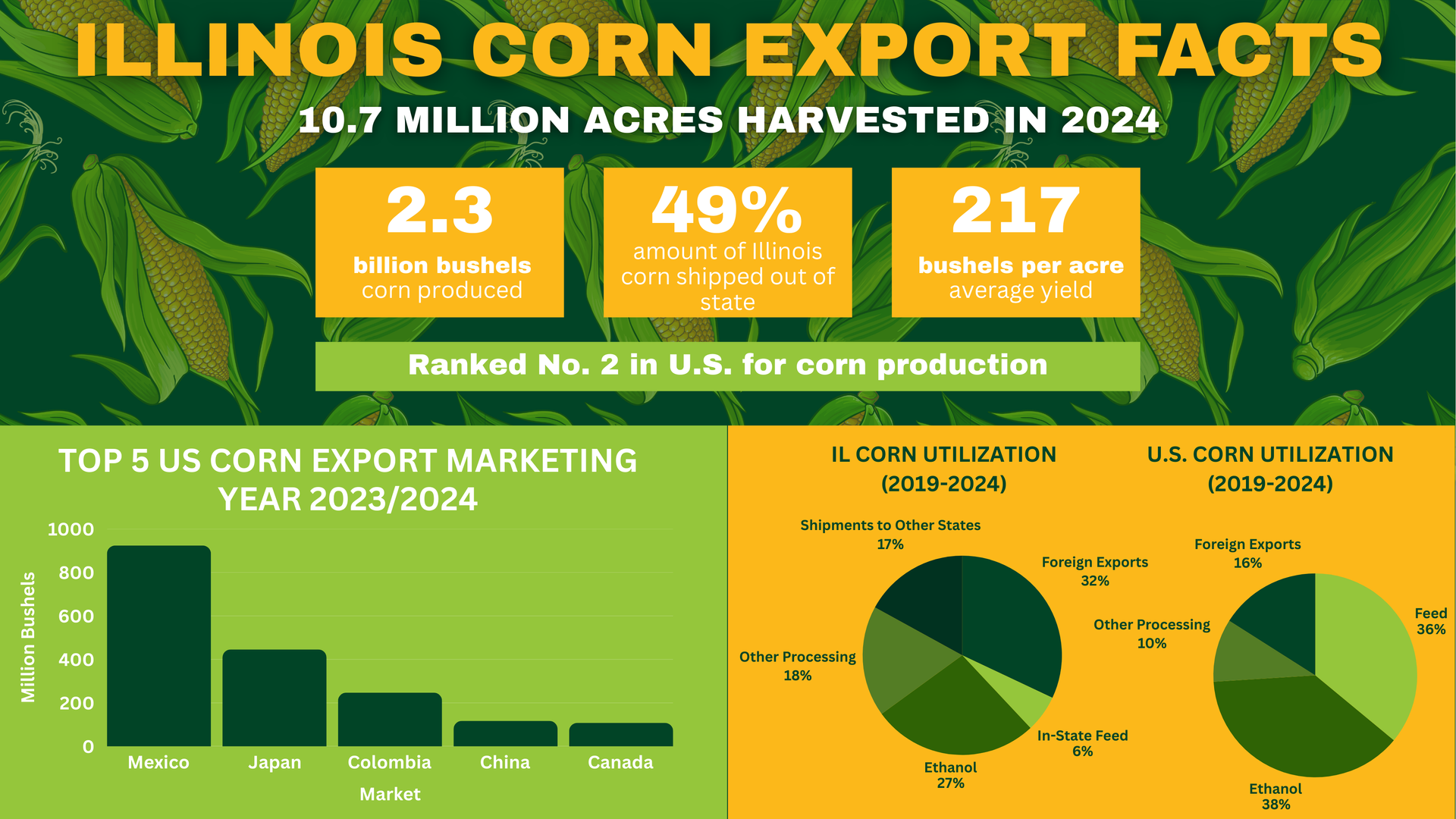

Illinois has a variety of efficient transportation means, including the waterways, rail, and roads. This leads to about half of corn produced in Illinois being shipped out of state. On average, about one third of Illinois corn production is destined for foreign markets. The top importer of U.S. corn is Mexico.

Building global demand is critical to making trade work and keeping U.S. farmers competitive. With 96 percent of consumers living outside the United States, the future of American agriculture largely depends on our ability to sell to foreign markets.

Rail Restrictions

About two-thirds of the grain the U.S. ships to Mexico moves by rail. Last year, there were rail capacity issues and freight delays during harvest. Mexico is expected to import even more of this year’s U.S. corn crop, making this an issue to watch. A repeat of disruptions in rail transport to Mexico could erode the U.S.’s proximity advantage, causing storage backups, and weakening basis.

Maritime Shipping Rates and Availability Concerns

U.S. corn competes with other exporters not only on the price of corn, but also on the price of freight. Trade restrictions and global conflicts have rerouted the ocean trade lanes, increasing freight costs. The U.S. government is also implementing a new port fee structure that has already disincentivized Chinese vessels from calling on U.S. port. The fees on ships built, owned, or operated by China are set to go into effect on October 14—right in the middle of harvest season. While the current rule includes exemptions dry bulk vessels, there are likely cost and availability implications for other shipments of goods like inputs and machinery coming to the U.S.

Barge Capacity on the Mississippi River

About 60 percent of the total U.S. grain for export is shipped by barge on the Mississippi River. The aging lock and dam systems weren’t designed for today’s massive 15-barge tows carrying over 750,000 bushels, leading to delays and increased costs. Low water levels, a recurring problem during harvest in recent years, reduce draft allowances and exacerbate delays and higher costs.

IL Corn continues to advocate for trade policy and transportation investments that benefit Illinois corn farmers.