President Trump’s Push for U.S. Shipbuilding: What It Means for Illinois Farmers

Background

On April 17, 2024, the Biden Administration initiated an investigation into China’s actions to unfairly monopolize the global shipbuilding market. This was done through Section 301 of the Trade Act of 1974, which allows the U.S. Trade Representative (USTR) to investigate and take action against foreign trade practices that are deemed unfair, unreasonable or discriminatory against U.S. commerce.

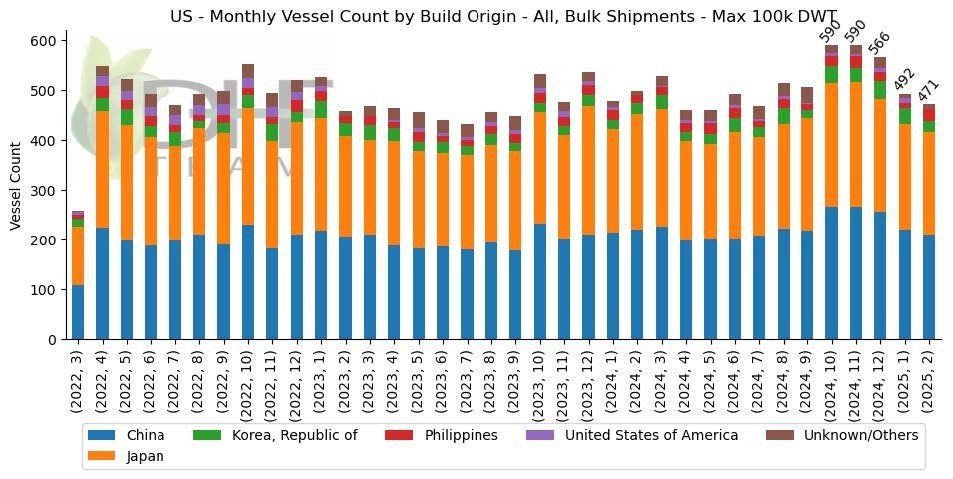

On February 21, 2025, the Trump Administration picked up the baton of this effort and proposed countermeasures against China’s unfair trade practices. The proposal would assess millions of dollars in fees on each port entrance – which is especially important for container movements – for Chinese shipping operators, Chinese-built ships, and non-Chinese operators that currently own or have ordered Chinese-built ships for their fleets. The Trump Administration also is proposing rules requiring exporters to utilize U.S. flagged and operated vessels, on an escalating schedule over the next seven years.

The size of the U.S. shipbuilding industry is supremely small. Of the roughly 21,000 bulk vessels operating around the world today, only seven are U.S. flagged and only five are U.S. built. To meet the Trump Administration’s goals for American production, the U.S. would need to build, operate and flag more than 900 Handymax vessels, and 400 Panamax vessels (or some combination of the two) within three years. For context, during peak ship production in the U.S. back in the 1970s, we only produced 15-20 ships per year.

Impacts on Illinois Corn Farmers

Illinois farmers export roughly 30% of our corn to foreign markets around the globe along with millions of gallons of ethanol and thousands of pounds of DDGs. Access and profitability in foreign markets is vital for the success of not just Illinois, but all of American agriculture. Per United States Department of Agriculture (USDA), in 2024 the U.S. exported more than $13.9 billion of corn to markets around the globe, with Mexico, Japan, Colombia, South Korea, and Canada being the top five for U.S. corn.

Considering only the proposed fees from the Trump Administration, corn farmers could expect to add 43¢-65¢ per bushel in transportation cost to foreign markets reached by ship. These fees will certainly depress farm gate prices, which would in turn have knock-on effects such as higher ending stocks, potentially driving prices further below the cost of production and encourage importers to source more grain from competitors in South American and the Black Sea region.

While we are not sure when the Trump Administration will make a final determination on what to do with this proposed rule, we are already seeing market impacts from the uncertainty reverberating around the globe. According to the National Grain and Feed Association (NGFA) options are currently limited to secure export vessels beyond late April/early May, increasing transportation costs by nearly 40%, making us less price-competitive internationally.

The president of National Corn Growers Association asked the Trump administration to grant exemptions on bulk shipments for America’s commodity groups as it considers implementing fees against Chinese vessels to level the playing field between U.S. and Chinese shipbuilders.

What’s Next?

As mentioned, we are not sure when a final determination will be issued on this rule, but planning for shifts in market profitability and transportation costs will be essential.

IL Corn recognizes the strategic importance of the shipbuilding industry and supports efforts to expand U.S. shipbuilding and servicing, as well as mariner development. The shipbuilding and associated industries are critical to national security and economic development. For decades, IL Corn has advocated for improvements to our waterways and other export channels because we know just how important all this is to Illinois corn farmers. As currently proposed, the shipping restrictions set unrealistic timelines, and the fees would unfairly burden Illinois farmers who rely on exports to make ends meet as we work towards the multigenerational effort to strengthen our economy and improve our standing in the world.