Featured Article

July 31, 2024

CHICAGO, Ill. -- Today, corn farmers and the ethanol industry were recognized by Illinois Governor J.B Pritzker and United Airlines as a sustainable partner in lowering the aviation industry’s carbon footprint. During a press conference, the airline announced it is the first company to use sustainable aviation fuel (SAF) at Chicago O’Hare International Airport. United’s one million gallons of SAF will begin arriving at O’Hare in August. "Since day one as Governor, I've committed to making Illinois a national leader in sustainability and clean energy, which is why I was proud to support a nation-leading SAF tax credit last year," said Governor JB Pritzker in a press release. "Illinois's position as a hub of innovation with some of the most connected airports in the country perfectly aligns with the work of companies like United to build a more sustainable future for travel and reach our shared goal of zero emissions." In 2020, United pledged to reduce 100% of the company’s carbon emissions by 2050. “I am excited to see United and our state’s leadership recognize the environmental and economic benefits corn offers our transportation sector,” Victoria farmer and IL Corn Growers Association President Dave Rylander said. “The SAF market will lower carbon emissions and has the opportunity to deliver the economic impact that will rejuvenate rural America.” The ethanol-to-jet process allows corn to serve as a low carbon feedstock for SAF production. SAF made of corn is molecularly identical to petroleum jet fuel. Corn-based SAF can reduce carbon emissions by over 50% when compared to conventional aviation fuel. Illinois is uniquely positioned to be a national SAF leader as the first state with a $1.50 SAF purchaser tax credit. This is the first time United has applied for the credit in Illinois. The state SAF purchaser incentive will expire December 31, 2032. A champion of corn, biofuels and SAF, U.S. Senator Tammy Duckworth (D- Ill.) shared her support in a press release. "I'm pleased to see United Airlines making this significant move forward by using sustainable aviation fuel daily in flights from O'Hare," Duckworth said. "One of the most important things we can do to make American aviation more sustainable is increase the supply of SAF. At the federal level, I've been pushing for the increased use of SAF, and I'm going to keep pushing to increase the supply of American-grown, American-made SAF, a true win-win solution that supports domestic farmers and blenders while reducing our nation's carbon footprint." ### About the IL Corn Growers Association IL Corn Growers Association is a state-based organization that represents the interests of corn farmers in Illinois, maintaining a high profile on issues in Washington, DC, and Springfield, IL. Through grassroots advocacy, ICGA creates a future for Illinois farmers in which they can operate freely, responsibly, and successfully. In order to fulfill this mission, the organization conducts governmental affairs activities at all levels, market development projects, and educational and member service programs. For further information regarding their work and involvement, visit their website www.ilcorn.org.

July 25, 2024

Today the IL Corn Growers Association (ICGA) submitted comments to the United States Department of Agriculture in an effort to impact corn demand and future ethanol markets. Illinois farmers have a role to play in helping U.S. ethanol plants capture the 45Z tax credit by lowering their carbon intensity (CI) score with low CI feedstocks like corn. ICGA comments will help ensure farmers are best positioned to receive some of that value regardless of location to an ethanol plant and with as much flexibility at the farm gate as possible. Following the release of the 40B Inflation Reduction Act (IRA) tax credit in April, the USDA asked for industry input when crafting conservation guidelines for the next IRA credit. The 45Z tax credit will give sustainable aviation fuel producers an incentive for products with carbon intensity (CI) scores reduced by 50%. “If written correctly, the 45Z tax credit could play a monumental role in recognizing the climate benefits of corn and creating unprecedented corn demand in new biofuel markets,” Director of Conservation and Nutrient Stewardship Megan Dwyer said, “Your team at IL Corn has had a seat at the table and worked hard to ensure the concerns of Illinois farmers are heard."

July 25, 2024

As Maddie Toman sat down in the Longworth Capitol building for her last Congressional visit of the day, a photo in the nearby display case caught her eye. The picture featured the Representative, whose office she sat in, standing outside the Capitol with students in corduroy blue jackets. She smiled as the photo made her feel quite at home and comfortable speaking up about her FFA and agricultural experiences on Capitol Hill.

July 23, 2024

1. What is a 'carbon market' and how do they work? There are three types of carbon markets available for farmer participation. Carbon Credit - Inset Accounts for GHG reductions as grain moves through the value chain to the end user. Provides farmers with credit for a sustainably produced crop Payment: credit in form MT CO2e-1/acre Payment Provider Example: Pepsico through Precision Conservation Management (PCM) Carbon Credit - Offset Pays farmers to reduce GHG emissions on behalf of a company outside of agriculture Payment: credit in form of MT CO2e-1/acre Payment Provider Example: Microsoft through Indigo Carbon Intensity (CI Scoring) A type of inset market that is most often associated with fuel production - 45z/40b payments Payment: a premium per bushel of grain Payment Provider Example: Ethanol Producer 2. What is a ‘carbon credit or CI score premium?’ A carbon credit certifies that someone, like a farmer, has taken action to remove/sequester carbon (cover cropping, reduced tillage, or planting a winter crop) or reduce greenhouse gas (GHG) emissions (reduced Nitrogen application). These credits or scores are often calculated by running a farmer’s practice data through different carbon credit or carbon intensity models. In inset or carbon intensity markets, the credit data travels with the grain to the final point of product sale, accounting for a farmer’s emissions reductions during agricultural product manufacturing (Example: emissions reductions for corn in Fritos or ethanol produced from corn). In an offset market, companies outside the agricultural value chain that want to offset their GHG emissions purchase credits from those implementing climate-smart practices. Many of these businesses need help from inside as well as outside of their supply chain to meet their climate-smart goals. (Example: Microsoft purchasing farmer-generated credits from Indigo ) 3. Who is driving carbon markets? Both companies and countries have made commitments to reduce their greenhouse gas emissions. Companies that utilize grain use inset credits to account for a farmer’s emissions within their value chain. For companies outside of the agricultural value chain, using agricultural offset credits is just one of the ways they are looking to reduce their environmental impact. 4. Are carbon markets regulated? No, carbon markets are currently unregulated. There is no USDA certification for greenhouse gas reducing practices, no regulatory system for measuring carbon capture standards, and no industry-wide voluntary standard for either certification or measurement. However, future regulation is possible. Currently, industry members are looking to create standards and streamline reporting. For inset markets, scientists and industry members are evaluating the guidance outlined in the GHG Protocol. For offset markets carbon programs often register their projects with carbon registries, such as Verra or Climate-Action Reserve , to provide credit buyers with quality assurance and eliminate the risk of greenwashing . 5. Can the price for carbon credits change? Yes, the price for carbon credits can change over the term of a contract. However, many programs have a minimum price floor. Payment terms also differ from program to program, with some paying a lump sum at the end of the season and others providing a deferred payment over a 5-year period for example. Be sure to check payment terms before signing a contract. 6. Can future legislation alter the terms of a carbon contract? It is unlikely. Regulations would typically only affect contracts signed after new legislation takes effect. However, if a state has a significant and legitimate public purpose for new legislation that substantially impairs contract obligations, it is possible for those obligations to be altered by later legislation. 7. Can farmers participate in other carbon capture programs? Carbon market contracts prohibit farmers from enrolling the same acre with multiple buyers. For example, you cannot enroll the same field in an offset, inset, and carbon intensity market in the same year. Verbal explanations about whether government programs count as carbon programs are not binding unless specified in the contract. 8. What are examples of practice requirements listed in carbon contracts? Examples include zero tillage, improved tillage, cover cropping, nitrogen management, pasture management, and buyer services. The specifics of these practices can vary per contract. 9. How are greenhouse gas emissions reductions and removals measured for carbon markets? There are currently no standardized metrics for measuring practices and carbon outcomes. Scientific models are commonly used to estimate GHG reductions and removals based on the adopted agricultural practices. For example, Precision Conservation Management (PCM) utilizes the Cool Farm Alliance – Cool Farm Tool and Field to Market to calculate carbon reductions and removals for our partners. These models can account for GHG emissions internationally. The USDA and Colorado State University developed COMET -planner, a domestic model for GHG emissions calculations. For US Biofuels, the GREET model, developed by Argonne National Laboratory, has been adopted to calculate carbon intensity associated with corn grown for ethanol production. 10. Is there an acreage minimum to participate? Acreage minimums vary significantly across programs. Some have no minimums, while others require at least 10 acres or more. 11. How long are farmers committed to carbon programs? Commitment lengths vary by program. It's essential to understand the contract length, terms, and exit clauses. Some programs have year-to-year (like PCM’s Pepsico program) contracts with annual renewal, while others require commitments of 10 to 20 years or more. Additionally, some programs account for factors like crop failures, weather, and soil conditions. 12. How can a farmer learn more? IL Corn offers a free program called Precision Conservation Management . PCM Specialists can help you benchmark your farm financials and use that data to help you enroll in their carbon inset or government cost-share programs. Additionally, PCM Staff has expertise in Illinois, Kentucky, and Nebraska conservation and carbon programs and can help you find the best program for your farming operation. Contact your local PCM specialist or IL Corn for more information.

July 23, 2024

This week, the IL Corn Growers Association joined over 530 organizations in a letter to House and Senate leadership calling upon Congress to pass a bipartisan farm bill. The letter was signed by representatives in the nutrition, agriculture, environmental and other sectors and relayed the coalition’s concerns of continued inaction.

July 22, 2024

Illinois farmers have an important role in the development of a new tax credit that offers U.S. ethanol plants incentives to produce lower carbon intensity (CI) biofuels from corn. The USDA is currently seeking advice regarding the conservation practices you’re using or would consider using on your farms that could lower the CI score of your corn, making lower CI biofuels. BACKGROUND A 40B tax credit for ethanol plants producing lower carbon intensity ethanol was released in May 2024. The tax credit was too late to influence management decisions on farms and is being used as guidance regarding how a future tax incentive would be built. Now, the USDA is assisting the U.S. Treasury to develop the next tax credit, 45Z, scheduled to be released in January 2025.

July 17, 2024

Exports of grain and grain products added $8.04 Billion in value to the Illinois economy in 2022, according to a ComplEat Analytics study commissioned by the U.S. Grains Council and the National Corn Growers Association. In an outstanding year for grain and grain product exports, Illinois grain and grain product exports were valued at $3.85 Billion . The value of these exports created ripple effects throughout the economy, positively impacting jobs, gross state product and economic output.

July 15, 2024

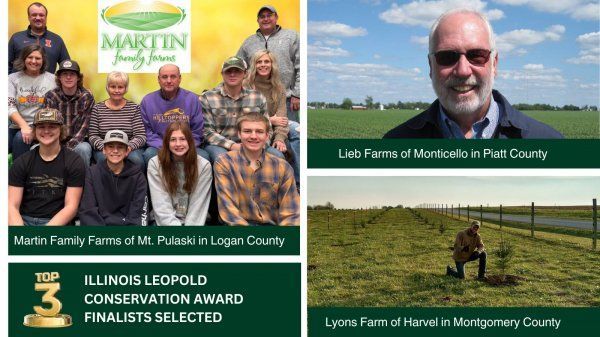

The finalists are: Lieb Farms of Monticello in Piatt County : Brothers Josh and Jake Lieb credit their late father Terry with being a firm believer in soil conservation. He planted trees and enrolled land in the Conservation Reserve Program. Today, his sons are engaged in a local effort to prevent pollution of Lake Decatur, which supplies drinking water to area residents. The Liebs grow cover crops and use no-till practices on their crop fields to prevent erosion. The streams they farm next to are well buffered with native species. Ponds and terraces were constructed to trap sediment and nutrients. Windbreaks and forests are managed to control invasive species and promote biodiversity and wildlife habitat.

Articles

2026

2025

2024

2023

2022

2021

2020